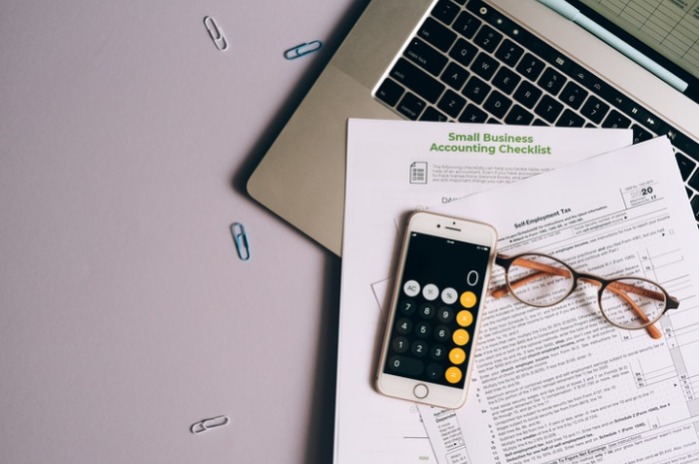

Every year, hundreds of thousands if not millions of people and companies file their tax returns in the UK as part of their legal obligations. A self-assessment tax return is a necessary part of life, whether you represent a trust, a limited company, you’re part of a partnership, a sole trader or an individual. In each of these cases, a UTR number is required. But what is a UTR and how can you get one if you haven’t done so already? We answer these questions and more here. Keep reading to find out.